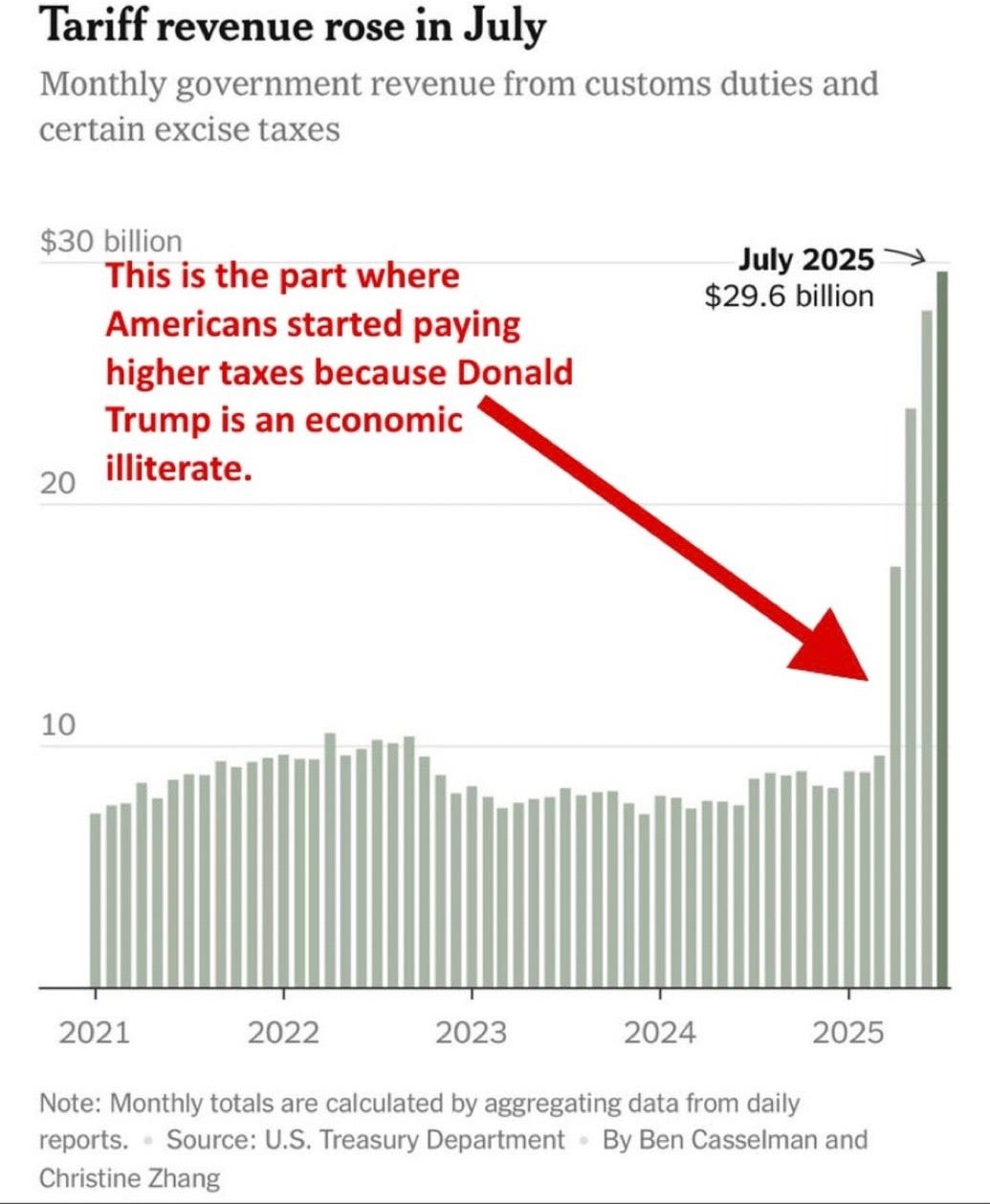

In July 2025, the U.S. government brought in $29.6 billion in tariff revenue. That’s not a typo. That’s nearly $30 billion in a single month—triple the average from previous years. It’s the kind of hockey-stick spike that should set off alarms. But to hear Donald Trump tell it, this is a triumph. “We’re making money again,” he crows at rallies. “Other countries are finally paying!”

Except they’re not. We are.

That money isn’t coming from China. It’s not coming from Mexico. It’s not being extracted from globalist trade cartels or shady overseas middlemen. It’s being paid by American families. By small businesses. By Etsy sellers, knife makers, Hallmark, Walmart, and yes—by you.

Tariffs are taxes. They always have been. And Trump’s “tariff strategy” is, in effect, a massive new federal tax—on top of the one you already pay every April. Call it the Trump Tax: a second pipeline of revenue flowing from American wallets directly into the U.S. Treasury.

And now, thanks to new data from the Treasury Department, we can see just how much we’re paying.

Trump’s New Tax: Where We Stand Today

As of August 2025, Trump has enacted the broadest, most aggressive set of tariffs in modern American history. Here’s where things stand:

Steel & aluminum (50%) – Enacted

Copper (50%) – Enacted

Automobiles & auto parts (25%) – Enacted

Universal “reciprocal tariff” (10%) – Enacted

Country-specific reciprocal tariffs (11%–50%) – Enacted

All Chinese goods (30%) – Enacted (reduced from 145% for 90 days)

Chinese goods (145%) – Paused

Canadian goods (35% + 10% on oil/gas) – Partially enacted

Mexican goods (25%) – Partially enacted

Imports from Venezuela-linked nations (25%) – Enacted

India (25%) – Set to activate Sept 17

Tariffs on 70 countries (10–41%) – In effect

Trump claims this strategy is about “economic strength” and “bringing manufacturing back.” In reality, it’s hitting American importers, consumers, and producers hard—and it’s already wreaking havoc on the very people who voted for him.

Real Stories, Real Damage

Let’s take a tour of the fallout:

1. Montana Knife Company

Josh Smith, founder of Montana Knife Co., made the mistake of believing his business was immune to tariffs because it was “Made in America.” But then his $515,000 German-made industrial knife sharpener arrived—with a $77,250 Trump tariff slapped on top. His patriotic pitch turned into a punch to the gut. The knife maker became a knife taker—of Trump’s tax.

2. Hallmark

You know, the card company your grandma still buys from. Hallmark makes about 75% of its products in the U.S. Still, it announced price increases across the board in May because Trump’s tariffs hit everything else: imported paper, specialty printing tools, packaging materials. They’re not importing Valentine’s Day cards from Beijing—but they’re still paying.

3. Busy Baby Mat

The founder of Busy Baby—an American-made product featured on Shark Tank—says Trump’s tariff shuffle was the “final nail in the coffin.” Why? Because even U.S.-based businesses rely on global inputs. When the cost of imported silicone shot up, so did her prices. Her customers disappeared.

4. The Tote Library

Founded by a 26-year-old entrepreneur, this European-based luxury tote bag brand expanded to the U.S. via TikTok Shop—until Trump’s 145% tariffs hit. In weeks, she lost 50% of her U.S. sales and had to suspend all stateside operations. You can’t sell a $60 bag with a 145% import fee.

5. Etsy Sellers and the Death of “De Minimis”

Trump killed the de minimis exemption that let small businesses import low-cost supplies without paying tariffs. Now, independent sellers who order $30 worth of hardware or packaging face a 25%–50% surcharge. One Etsy creator went viral crying into the camera: “My side hustle is dead.”

6. Walmart and Dollar General

Even the giants aren’t safe. Walmart is already warning of coming price hikes across apparel, toys, and electronics. Dollar General—already struggling with supply issues—is facing brutal choices: raise prices or cut quality. Either way, their working-class customers lose.

A Tax That Hits Everyone

The lie Trump tells is simple: “Tariffs make other countries pay.” But tariffs are import taxes. They’re levied at the border, collected by U.S. Customs from American importers, who then raise prices to cover the cost. The only people “paying” other than us are the folks running small farms in China or paper mills in Quebec—people who can’t vote in our elections.

Thousands of small business owners are facing tariff caused container charges that will force them out of business.

Businesses relying on imports (and as the Montana Knife Company learned, even shit that is Made in America has a supply chain reliant on imports) aren’t the only people being crushed by Trump’s tariffs. American consumers are the ones footing the bill. And because these taxes are embedded in the prices of everyday goods—from baby bottles to brake pads—they hit everyone, not just the rich.

This is what makes them regressive. They function just like a sales tax, which hits lower-income families harder. Congratulations, America: Trump just gave you a nationwide sales tax without Congress passing a thing.

The Political Cost

For a guy who used to dominate on economic approval, Trump’s tariff scheme is starting to bleed him out.

Recent polling shows a sharp decline in confidence in Trump’s handling of the economy. As prices rise and business owners speak out, even some of his base is starting to feel betrayed. The sentiment? “I voted for lower taxes, not higher ones.” Oops.

In swing states, the stories are multiplying. Knife makers. Boutique owners. Homebuilders. Resellers. Trucking firms. Biden doesn’t need to persuade them—he just needs to point.

Because once you show people that Trump’s tariffs are just taxes with a new hat, the whole con unravels. He’s not punishing China. He’s punishing us—and pretending it’s patriotism.

Trump is Bragging About Taxing You Twice

Trump wants credit for revenue that came from you. He wants to boast about money that was taken out of your business, your savings, your kid’s backpack, your grocery cart.

This is the second federal tax now. First, you pay income tax. Now, you pay the Trump Tax every time you buy something.

And if you try to say it’s hurting you, MAGA calls you unpatriotic. If you’re a business owner who dares to complain, they call you weak. But this isn’t weakness—it’s reality.

The tariffs are here. The bills are here. And the fallout is already reshaping the political battlefield.

Let’s make sure voters understand what they’re really paying for.

Because that $29.6 billion?

That wasn’t China’s money.

It was yours.

-Rachel

All good information, but in the wrong hands. Those of us reading this, by and large, are the "already converted" or ” the choir" if you will.

You need to get this information into the eyes and ears of the rest of America, MAGA voters.

Preaching to us and hawking books won't get us anywhere in 2026, much less in 2028.

Great information~. If I hear a "Republican" talking the lies they are told, I asked them if they'd like some more "facts" about the topic. I don't tell them it's contrary to what they're told, I just like to see if they have the level of ignorance to ignore reality.